Millions of people read self-help books for help to get inspiration in their personal and professional lives.

Self-help books are my constant companions on this journey of growth. They’ve offered solace, practical tools, and a renewed sense of possibility.

Not every book is perfect, but some become life-changing and will inspire you to explore their self-discovery and transformation.

In this guide, I will share the 50 best self-help books that are the most helpful for you. Many of these literary treasures offer wisdom, practical advice, and inspiring stories that have inspired you.

These books tell you how to overcome challenges, improve yourself, and get rich.

They cover many topics, from relationships and communication to mindset and motivation, and help readers become their best version.

So, Let’s Dive In!

- Self-Help Books for Personal Transformation

- 1. The Magic of Thinking Big by David J. Schwartz

- 2. Think & Grow Rich by Napoleon Hill

- 3. The Power of Positive Thinking by Dr. Norman Vincent Peale

- 4. Awaken the Giant Within by Tony Robbins

- Best Self-Help Book To Boost Self-Discipline

- 5. No Excuses by Brian Tracy

- 6. Mini Habits By Stephen Guise

- 7. The Power of Habit by Charles Duhigg

- 8. Eat That Frog by Brian Tracy

- Self-help Books To Improve Emotional Intelligence

- 9. Emotional Intelligence 2.0 Travis Bradberry & Jeans Greaves

- 10. Emotional Intelligence: Why It Can Matter More Than IQ by Deniel Goleman

- 11. How to win Friends and influence By Dale Carnegie

- 12. Thinking Fast and Slow by Daniel Kahneman

- Best Personal Finance Books of All Time

- 13. Rich Dad, Poor Dad by Robert T. Kiyosaki

- 14. Money Master The Game by Tony Robbins

- 15. I Will Teach You To Be Rich by Ramit Sethi

- 16. The Simple Path to Wealth by JL Collins

- Best Books on Growth Mindset and Self-improvement

- 17. The 48 Laws of Power by Robert Greene

- 18. The 7 Habits of Highly Effective People by Stephen. R. Covey

- 19. The Psychology of Money by Morgan Housel

- 20. Mindset: The New Psychology of Success by Carol S. Dweck

- Best Happiness Books of All Time

- 21. The Art of Happiness by the Dalai Lama and Howard C. Cutler

- 22. Authentic Happiness by Martin Seligman

- 23. Stumbling on Happiness by Daniel Gilbert

- 24. The Happiness Trap: Stop Struggling, Start Living by Russ Harris

- Best Self-Help Books of All Time

- 25. The Alchemist Book Paulo Coelho

- 26. The Richest Man In Babylon

- 27. The Power of Your Subconscious Mind by Joseph Murphy

- Best Self-Help Books On Habit To Embrace Growth

- 28. Atomic Habits by James Clear

- 29. The Creative Habit by Twyla Tharp

- 30. Start With Why By Simon Sinek

- 31. Mini Habits: Smaller Habits, Bigger Results by Stephen Guise

- Time Management and Productivity Books of All Time

- 32. The Science Of Self-Discipline By Peter Hollins

- 33. Make Your Bed Summary (William H. McRaven)

- 34. Organize Tomorrow, Today by Dr. Jason Selk and Tom Bartow

- 35. Deep Work by Cal Newport

- Popular Psychology Self-Help Books

- 36. Flow: The Psychology of Optimal Experience by Mihaly Csikszentmihalyi

- 37. Influence: The Psychology of Persuasion by Robert B. Cialdini

- 38. The Subtle Art of Not Giving a F*ck by Mark Manson

- 39. Who Moved My Cheese? Spencer Johnson

- Best Self-help Books On Mindfulness

- 40. The Miracle of Mindfulness’ by Thich Nhat Hanh

- 41. Practicing Mindfulness by Matthew Sockolov

- 42. Wherever You Go, There You Are by Jon Kabat-Zinn

- 43. Mindfulness by Danny Penman and Mark Williams

- Best Self-Help To Improve Health

- 44. The Obesity Code By Dr. Jason Fung

- 45. How Not to Die by Dr. Michael Greger

- 47 Ikigai

- 48. The Well Plated Cookbook by Erin Clarke

- Best Self-Help Books On Relationships

- 48. The Seven Principles for Making Marriage Work by John M. Gottman, Ph.D.

- 49. Big Friendship by Aminatou Sow and Ann Friedman

- 50. Adult Children of Emotionally Immature Parents by Lindsay C. Gibson, Psy.D.

Self-Help Books for Personal Transformation

1. The Magic of Thinking Big by David J. Schwartz

“Most of us make two basic errors with respect to intelligence: 1. We underestimate our own brainpower. 2. We overestimate the other fellow’s brainpower.”

David J. Schwartz

This book is for people who want to achieve success and who wish to change their defeat mindset into thinking big.

As the name suggests, The Magic of Thinking Big by David J. Schwartz helps you to live a successful and happy life. Learn strategies to reach their goals, and believe in yourself.

The book by Davids offers several ways to cultivate and reinforce the most important qualities of successful people.

Here are proven approaches to life situations, and some universally applicable approaches and steps work like magic

2. Think & Grow Rich by Napoleon Hill

“The person who stops studying merely because he has finished school is forever hopelessly doomed to mediocrity, no matter what may be his calling. The way of success is the key of continuous pursuit of knowledge.”

Napoleon Hill

The Napoleon Hill book Think and Grow Rich is more than just a book. It is a timeless manual for anyone seeking personal and financial success.

The book tells you how to be successful and rich by thinking positively, trying, and doing what you must.

Many successful people have used Hill’s ideas and rules. This longevity is a testament to the book’s effectiveness and relevance, even in today’s fast-paced world.

Hill also provides many examples of successful people who have used the principles to succeed.

3. The Power of Positive Thinking by Dr. Norman Vincent Peale

“The way to happiness: Keep your heart free from hate, your mind from worry. Live simply, expect little, give much. Scatter sunshine, forget self, think of others. Try this for a week and you will be surprised.”

Norman Vincent Peale

Unlike some self-help books that offer vague advice, Peale provides concrete, practical techniques for overcoming negative thoughts and habits. These strategies are designed to be easy to implement in daily life.

The book’s main idea is that the mind has the power to shape one’s reality and that positive thinking can lead to positive outcomes.

Peale says that it’s important to have a positive attitude, overcome negative thoughts and emotions, and have faith in one’s abilities.

He gave advice and strategies for developing a positive mindset, like affirmations, visualization, and prayer.

He also gives many examples of people who have used positive thinking to overcome obstacles, succeed, and find happiness.

4. Awaken the Giant Within by Tony Robbins

“Achievers rarely, if ever, see a problem as permanent, while those who fail see even the smallest problems as permanent.”– Tony Robbins

“Unleash the Giant Within” is based on the notion that everyone possesses immense potential that’s just waiting to be unleashed. Robbins guides readers through the process of tapping into and realizing this potential.

The book contains practical techniques and actionable strategies that readers can apply daily.

Robbins provides practical strategies and techniques for developing a positive mindset, setting and achieving goals, and improving relationships. He says that it is important to act and make changes to reach your goals.

He gives readers exercises and tools to help them identify their core values, beliefs, and habits and then plan to change them if necessary.

Best Self-Help Book To Boost Self-Discipline

5. No Excuses by Brian Tracy

“The Law of Forced Efficiency says, “There is never enough time to do everything, but there is always enough time to do the most important things.”

Brian Tracy

Tracy explores how self-discipline impacts various areas of life, including personal goals, business and career success, money management, and happiness.

This book guides developing unwavering self-discipline, the key ingredient for achieving any goal. Tracy shows you how to stop putting things off and take action instead. This will help you overcome any problem with confidence.

Tracy stresses the importance of taking responsibility for one’s actions and not making excuses for failure or lack of progress.

This isn’t just a motivational book; it’s a practical manual. Each chapter concludes with exercises and self-assessment tools to help you implement the learned strategies and analyze your progress.

6. Mini Habits By Stephen Guise

“a mini habit is a VERY small positive behavior that you force yourself to do every day. Small steps work every time, and habits are built by consistency, so the two were meant to be together.”

Stephen Guise

Mini Habits is a revolutionary book that offers a simple yet powerful strategy for developing habits that can lead to significant personal growth and success.

Throughout the book, the author introduces the concept of “mini habits,” which are small positive behaviors you force yourself to do daily.

These habits are too small to fail, so they can be done in small, easy steps but make big, lasting changes.

Guise also addresses common obstacles to habit formation, such as procrastination and lack of motivation.

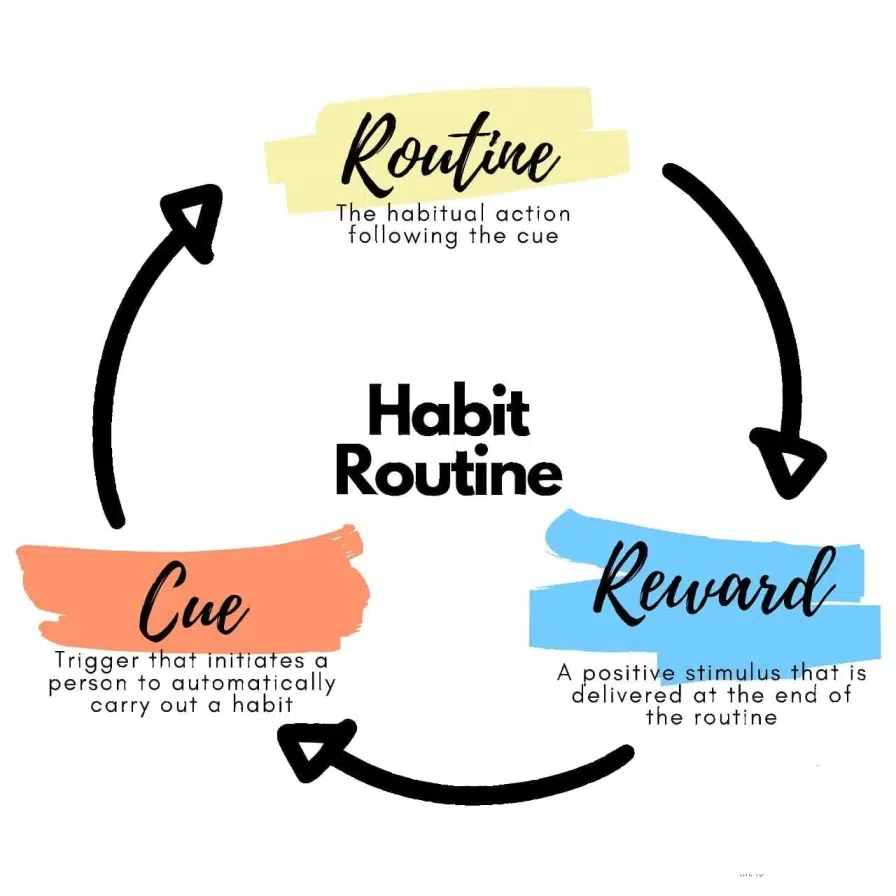

7. The Power of Habit by Charles Duhigg

“Change might not be fast and it isn’t always easy. But with time and effort, almost any habit can be reshaped.”

Charles Duhigg

Charles Duhigg’s The Power of Habit: Why We Do What We Do in Life and Business is a compelling and informative book that explores the science behind habits and how to change them.

The author explores the neuroscience and psychology behind why habits form and how they can be changed.

It is more than a theory about habits; it is also a guide to changing them. He discusses how habits impact our lives in various ways, from personal habits like exercise to diet.

He also gives tips and tools for changing habits, such as identifying habit cues, making new routines, and using rewards to make positive habits stronger.

8. Eat That Frog by Brian Tracy

“The hardest part of any important task is getting started on it in the first place. Once you actually begin work on a valuable task, you seem to be naturally motivated to continue.”

Brian Tracy

We all have an endless list of tasks to complete and have limited time to complete them effectively.

In Eat That Frog, Brian Tracy teaches that to achieve more, you must focus on your single most important task and take immediate action.

Tracy’s “frog” analogy is memorable and works well.

What does it offer for you?

Actionable strategies to help you stop procrastinating, prioritize effectively, improve productivity, and achieve more in less time.

Self-help Books To Improve Emotional Intelligence

9. Emotional Intelligence 2.0 Travis Bradberry & Jeans Greaves

“Emotional intelligence is your ability to recognize and understand emotions in yourself and others, and your ability to use this awareness to manage your behavior and relationships.”

Travis Bradberry

Emotional Intelligence 2.0″ by Travis Bradberry and Jean Greaves is a groundbreaking guide that provides practical strategies to measure and increase emotional intelligence (EQ) accurately.

The book talks about how EQ is important for personal and professional success. The author also provides a step-by-step approach to improving the four core EQ skills: self-awareness, self-management, social awareness, and relationship management.

10. Emotional Intelligence: Why It Can Matter More Than IQ by Deniel Goleman

“Anyone can become angry —that is easy. But to be angry with the right person, to the right degree, at the right time, for the right purpose, and in the right way —this is not easy.

Do you know we need ONE important skill for stronger relationships and greater success? That Is emotional intelligence.

Emotions are involved everywhere in all our decisions. Our emotions help us to understand us and the world around us. It also helps us to make decisions.

People usually think that emotions only come out when anger or love is present. Danial Goleman’s Unleash the Potential of Emotional Intelligence explains this.

KNOW. What’s the impact of emotion on your everyday life? How this emotion helps you can also fool you if you don’t use it properly.

So, let’s find out the answer to all these questions in this wonderful Book, Emotional Intelligence.

11. How to win Friends and influence By Dale Carnegie

“You can make more friends in two months by becoming interested in other people than you can in two years by trying to get other people interested in you.”

Dale Carnegie

Despite being published in the 1930s, the advice in the book remains timeless and universally applicable. The principles of human nature explored by Carnegie are as relevant today as they were when the book was first written.

Key Principles from How to Win Friends and Influence People

- Become genuinely interested in others.

- A sincere smile is a powerful tool for making a positive impression.

- Remember that a person’s name is the sweetest and most important sound to that person.

- Try to remember and use people’s names correctly.

- Listen attentively without interrupting, and show genuine interest in what they have to say.

- Make the other person feel important – and do it sincerely.

- Avoid criticizing, condemning, or complaining.

- Respect the other person’s opinions and feelings.

- Try honestly to see things from the other person’s perspective.

- Be sympathetic to the other person’s ideas and desires.

- Make your ideas more engaging and memorable by storytelling using vivid language.

12. Thinking Fast and Slow by Daniel Kahneman

“A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth. Authoritarian institutions and marketers have always known this fact.”

Daniel Kahneman

Thinking, Fast and Slow is a non-fiction book by Nobel Prize-winning economist and psychologist Daniel Kahneman.

The book explores how humans think and make decisions and how biases and cognitive errors can influence our thinking.

Kahneman argues that there are two primary systems of thinking in our brains.

- System 1 which is fast, intuitive, and automatic

- System 2 which is slow, analytical, and deliberate

He demonstrates how these systems work together to shape our perceptions, judgments, and decisions.

Kahneman uses examples from psychology and behavioral economics to show how biases, such as confirmation bias, hindsight bias, and availability bias, can affect our thinking.

He also examines the role of emotions in decision-making and the limitations of our ability to predict the future.

Best Personal Finance Books of All Time

13. Rich Dad, Poor Dad by Robert T. Kiyosaki

“The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.”

Robert T. Kiyosaki

Rich Dad Poor Dad’s book describes Kiyosaki’s two fathers, his real father (the poor dad) and the father of his best friend (the rich dad), and their differing financial philosophies.

The book tells the story of how Kiyosaki became successful and encourages readers to do the same. It is my first self-help book; I have learned much from it.

Kiyosaki emphasizes the importance of financial education, building assets, and creating passive income.

He says the traditional education path leading to a stable job and retirement savings is flawed.

Instead, he encourages readers to focus on creating wealth through investing, entrepreneurship, and financial literacy.

Throughout the book, Kiyosaki offers advice on investing, taxes, and personal finance management.

14. Money Master The Game by Tony Robbins

“Life isn’t about waiting for the storm to pass; it’s about learning to dance in the rain. It’s about removing the fear in this area of your life so you can focus on what matters most.”―

Anthony Robbins

This book provides an in-depth exploration of the world of personal finance and investing. The book covers many topics, including saving and investing, insurance, and retirement planning.

The author provides practical advice for readers wanting to control their financial future.

He also offers his advice on topics such as asset allocation, tax planning, and retirement savings.

Robbins stresses the importance of taking a long-term view of investing. He advocates for the use of low-cost index funds and diversification.

15. I Will Teach You To Be Rich by Ramit Sethi

“There is a limit to how much you can cut but there is no limit to how much you can earn.”

Ramit Sethi

Ramit Sethi’s book “I Will Teach You To Be Rich” offers a straightforward and practical roadmap to achieving financial freedom.

The book is for young adults who want to learn how to manage their money.

Sethi covers various topics, including budgeting, saving, investing, and debt management. He also shares his own personal experiences and insights to help readers make informed financial decisions.

He recommends that readers learn more about their personal finances and plan to reach their financial goals. He also gives tips for negotiating bills and increasing income.

Sethi uses relatable examples and pop culture references to make personal finance more approachable for readers.

16. The Simple Path to Wealth by JL Collins

“It’s not hard. Stop thinking about what your money can buy. Start thinking about what your money can earn. And then think about what the money it earns can earn.”

J.L. Collins

If you want to cut through the financial noise and complexity, The Simple Path to Wealth delivers a timeless blueprint for growing long-term wealth.

The book is well-liked because it gives clear and practical advice that can help people reach their money goals and live a happy and free life. He gives advice on how to become financially independent and retire early.

Collins simplifies the process of accumulating wealth into a straightforward plan that anyone can follow and comprehend.

He says investing in low-cost index funds that cover many countries, setting up automatic contributions, and avoiding the financial news hype is good.

The author of this book wants to help people of all income levels take charge of their finances and live life on their own terms.

Collins says that readers should focus on the things that really matter in life, like family, friends, and experiences.

Best Books on Growth Mindset and Self-improvement

17. The 48 Laws of Power by Robert Greene

Appearing better than others is always dangerous, but most dangerous of all is to appear to have no faults or weaknesses. Envy creates silent enemies. It is smart to occasionally display defects, and admit to harmless vices, in order to deflect envy and appear more human and approachable. Only gods and the dead can seem perfect with impunity.”

Robert Greene

The quest for power is timeless. Humans constantly try to get control, influence, and authority over others in the office, boardroom, church, or classroom.

But how is power gained, lost, and maintained in all aspects of life? In his classic The 48 Laws of Power, seasoned author Robert Greene unravels this question.

Since its release in 1998, this has become a bible for millions, from executives and entertainers to politicians.

The 48 Laws examines the shady social game of power by profiling the tactics and habits of its greatest historical practitioners.

It will help you discover the calculated, subtle factors determining who wields power and control in society. It shows how important things happen in politics, business, and everyday life.

18. The 7 Habits of Highly Effective People by Stephen. R. Covey

“To change ourselves effectively, we first had to change our perceptions.”

Stephen R. Covey

The book discusses how to improve yourself by building inner character and integrity.

He believes that we see the world entirely based on our perceptions. To change a situation, we must change ourselves; to change ourselves, we must be able to change our perceptions.

The book comprises seven habits that go from dependence to independence to interdependence.

The seven habits are:

- Be Proactive: Take responsibility for your life, and do not blame others for your circumstances.

- Begin with the End in Mind: Have a clear vision of what you want to achieve, and align your actions with that vision.

- Put First Things First: This means prioritizing your tasks and focusing on the most important things first.

- Think Win-Win:. Seeking mutually beneficial solutions in all of your interactions.

- Seek first to Understand, then to Be Understood: Listen and try to understand others’ perspectives before trying to make them understand yours.

- Synergize: working together to create something greater than the sum of its parts.

- Sharpen the Saw: taking care of yourself physically, mentally, emotionally, and spiritually.

These habits are essential for success in all aspects of life, from personal relationships to business and leadership.

19. The Psychology of Money by Morgan Housel

“Spending money to show people how much money you have is the fastest way to have less money.”

Morgan Housel

This book will give you a more in-depth understanding of the psychology of money and how to make better financial decisions. I have learned valuable lessons from it that have helped me have better financial discussions.

This book explores the complex relationship between people and money. And explains how our attitudes and beliefs influence our financial decisions.

The book also has short stories about how money, wealth, greed, and happiness work. How luck affects financial success, and how culture and society affect our attitudes toward money.

The book covers various topics like compounding works and the importance of humility in investing.

20. Mindset: The New Psychology of Success by Carol S. Dweck

“If parents want to give their children a gift, the best thing they can do is to teach their children to love challenges, be intrigued by mistakes, enjoy effort, and keep on learning. That”

Carol S. Dweck

is a transformative book that explores the concept of mindset and its impact on personal and professional success.

Dweck’s research delves into the idea of fixed and growth mindsets.

- A fixed mindset is the belief that your intelligence, abilities, and other qualities are predetermined.

- A growth mindset is an idea that hard work and dedication can improve one’s abilities and intelligence.

Dweck’s research has shown that a growth mindset is a better way to think about success. People who have a growth mindset are more likely to reach their goals and be happy, healthy, and fulfilled.

Best Happiness Books of All Time

21. The Art of Happiness by the Dalai Lama and Howard C. Cutler

“We can see how a calm, affectionate, wholesome state of mind has beneficial effects on our health and physical well-being. Conversely, feelings of frustration, fear, agitation, and anger can be destructive to our health.”

Dalai Lama

The Art of Happiness explores the Dalai Lama’s views on achieving happiness. The book is a combination of Buddhist meditations and common-sense advice.

The book is based on interviews with the Dalai Lama conducted by a psychiatrist interested in Western psychology and Buddhist philosophy.

It discusses the nature of happiness and the importance of compassion and kindness. The role of religion and spirituality in finding happiness and the power of the mind to shape our experiences.

He also stresses the value of developing a strong sense of compassion and empathy for others and a deep sense of interconnectedness with all living beings.

22. Authentic Happiness by Martin Seligman

“Authentic happiness derives from raising the bar for yourself, not rating yourself against others.”

Martin E.P. Seligman

Authentic Happiness is a book by Martin Seligman, a renowned psychologist and founder of positive psychology.

The book explores the nature of happiness and offers practical strategies for achieving greater well-being and fulfillment in life.

Seligman argues that traditional psychology has focused too much on treating mental illness and not enough on promoting positive emotions and experiences.

He introduces the concept of “positive psychology,” which emphasizes the importance of cultivating positive emotions, strengths, and virtues.

The book covers various topics, including the science of happiness and the role of positive emotions in well-being.

23. Stumbling on Happiness by Daniel Gilbert

“People want to be happy, and all the other things they want are typically meant to be a means to that end.”

Daniel Gilbert

The book talks about many different things, like the psychology of memory and how imagination can help us predict future emotions.

It is argued that humans are not excellent at predicting what will make them happy in the future and that our beliefs about what will make us happy are often wrong.

Gilbert says that focusing on the present moment cultivates gratitude and positive emotions. Having a sense of purpose and meaning in life is always important.

24. The Happiness Trap: Stop Struggling, Start Living by Russ Harris

“Psychological flexibility is the ability to adapt to a situation with awareness, openness, and focus and to take effective action, guided by your values.”

Russ Harris

The Happiness Trap by Russ Harris helps you overcome psychological obstacles that can keep you from being happy and fulfilled in life.

Harris draws on the principles of ACT, a form of therapy that focuses on developing psychological flexibility and mindfulness.

Harris also offers many practical strategies and exercises for increasing psychological flexibility, such as

- Mindfulness meditation

- Cognitive delusion

- Values-based goal setting.

The book teaches that happiness is a state of mind that can be cultivated through acceptance and mindfulness.

Harris suggests that you should be open to their feelings, even if they are difficult, and try to be more understanding and kind to yourself.

Best Self-Help Books of All Time

25. The Alchemist Book Paulo Coelho

Paulo Coelho’s The Alchemist is more than just a book; it’s a map of the hidden treasures within ourselves. This unforgettable novel is about the essential wisdom of listening to our hearts and following our dreams.

I really liked the story about a shepherd named Santiago. It made me think about myself and inspired me to pursue my goals.

Let’s dive into the story of Santiago, the shepherd, and see how his journey can inspire our own.

26. The Richest Man In Babylon

The journey to financial wisdom begins in the ancient city of Babylon, where timeless secrets of wealth and prosperity have been passed down through generations.

The Richest Man in Babylon is a classic that has enlightened millions with its simple yet profound financial principles. This book will teach you how to grow wealth and ensure a prosperous future.

Join us as we uncover the age-old secrets hidden in its pages, guiding you toward a life of abundance and financial freedom.

27. The Power of Your Subconscious Mind by Joseph Murphy

“Busy your mind with the concepts of harmony, health, peace, and good will, and wonders will happen in your life.”

Joseph Murphy

The book explores the power of the human mind and how it can be used to achieve success, happiness, and personal fulfillment.

Murphy’s approach to harnessing the power of the subconscious mind is based on the belief that the mind is a two-part system: conscious and subconscious.

- The conscious mind is the part of the mind that we are aware of,

- while the subconscious mind is the part of the mind that is not consciously aware of.

Murphy says that the subconscious mind is much more powerful than the conscious mind and that we can do anything we want by tapping into its power.

We can harness this power through techniques such as visualization, affirmation, and positive thinking.

Best Self-Help Books On Habit To Embrace Growth

28. Atomic Habits by James Clear

“Every action you take is a vote for the type of person you wish to become. No single instance will transform your beliefs, but as the votes build up, so does the evidence of your new identity.”

James Clear

As we all know, habits shape our lives, determining our successes and failures. But how can you make good habits?

The Atomic Habits book provides powerful and clear steps for building positive habits and breaking negative ones. It outlines how to design successful systems using cues, cravings, responses, and rewards.

It helps you understand how you can break bad habits in four simple steps:

- 1st law (Cue): Make it invisible.

- 2nd law (Craving): Make it unattractive.

- 3rd law (Response): Make it Difficult.

- 4th Law (Reward): Make it unsatisfying.

29. The Creative Habit by Twyla Tharp

“I read for growth, firmly believing that what you are today and what you will be in five years depends on two things: the people you meet and the books you read.”

Twyla Tharp

Tharp is a renowned choreographer and dancer. The book draws on her extensive experience in the creative arts to offer principles and strategies for cultivating creativity.

Tharp says that it’s important to have regular creative practice and gives tips on how to do it.

She encourages people to establish rituals and routines that help them create a creative mindset.

Creative thinking is not simply a matter of inspiration or talent; it requires consistent effort and practice.

Tharp also says that collaboration and feedback are important parts of the creative process and gives tips on how to work well with others.

30. Start With Why By Simon Sinek

In today’s competitive world, businesses want to be noticed and gain market share.

But why do some companies succeed in winning hearts, retaining loyal customers, and inspiring innovation while others struggle?

Simon Sinek’s groundbreaking book, “Start with Why,” dissects this puzzle, revealing the missing ingredient at the root of great leadership and sustainable success.

This summary explains the ‘Golden Circle’, an important idea that will change your thoughts about business, leadership, and goals.

His main IDEA:

Focus on why you’re doing something that makes you more likely to succeed.

31. Mini Habits: Smaller Habits, Bigger Results by Stephen Guise

“…Every giant accomplishment is made of very small steps… and to take them one at a time like this is not weak, but precise.”

Stephen Guise

The book focuses on overcoming procrastination and increasing productivity. Guise says that procrastination is not a result of laziness or a lack of willpower.

He talks about scheduling, a technique that arranges tasks in order of importance. Instead of trying to do as many as possible, make the task funny.

The book also emphasizes the importance of setting realistic goals and breaking tasks down into smaller, more manageable steps.

The book also offers practical strategies for healing and moving forward, including developing healthy boundaries, improving communication skills, and practicing self-care.

Time Management and Productivity Books of All Time

32. The Science Of Self-Discipline By Peter Hollins

“We must all suffer one of two things: the pain of discipline or the pain of regret.”

Peter Hollins

In this book, the author explains how self-discipline is influenced by psychological and neural mechanisms and how you can train your brain to be more disciplined.

He provides strategies for overcoming procrastination, staying focused, and managing time effectively.

Additionally, Hollins recommends developing habits that help you stay in control and gives specific tips for doing this.

By blending scientific research with actionable techniques, the book provides readers with the knowledge and tools to cultivate self-discipline and achieve their goals.

33. Make Your Bed Summary (William H. McRaven)

Make Your Bed book is about an incident where Admiral McRaven (the author) gave a speech to the graduating class from the University of Texas on 17th May 2014. The graduating class embraced the speech.

McRaven (Mac) tells about ten lessons he learned from Navy SEAL Training.

He illustrates these principles using stories from his military career and provides practical advice on applying them to everyday life.

34. Organize Tomorrow, Today by Dr. Jason Selk and Tom Bartow

“Mental toughness is the ability to focus on and execute solutions, especially in the face of adversity.

Dr. Jason Selk

‘Organize Tomorrow Today’ is a valuable resource for anyone looking to improve their productivity and achieve their goals.

The authors discuss Mental Toughness, which means working well, being less stressed, staying focused, and reaching goals.

They provide a step-by-step process for building mental toughness, including goals, priorities, and time management strategies.

35. Deep Work by Cal Newport

“If you don’t produce, you won’t thrive—no matter how skilled or talented you are.”

Cal Newport

Cal Newport talks about deep work, which is the ability to focus on hard tasks for a long time without being distracted.

Deep work is becoming increasingly important in today’s knowledge economy. Newport helps you develop deep work habits, such as blocking out time, eliminating distractions, and creating a good environment for concentration.

The book addresses balancing work and personal commitments, such as balancing work and family.

The benefits of deep work go beyond productivity. They include improved creativity, professional growth, and overall satisfaction.

Popular Psychology Self-Help Books

36. Flow: The Psychology of Optimal Experience by Mihaly Csikszentmihalyi

“Most enjoyable activities are not natural; they demand an effort that initially one is reluctant to make. But once the interaction starts to provide feedback to the person’s skills, it usually begins to be intrinsically rewarding.”

Mihaly Csikszentmihalyi

Mihaly Csikszentmihalyis’s book explores the concept of flow, which is a state of complete absorption and engagement in an experience.

The book describes how flow can lead to happiness, productivity, and personal growth.

His research in psychology and interviews with people who have experienced flow in various domains, including sports, music, and work.

It emphasizes the importance of finding meaning and purpose in one’s activities and offers practical advice on cultivating flow in everyday life.

37. Influence: The Psychology of Persuasion by Robert B. Cialdini

“A well-known principle of human behavior says that when we ask someone to do us a favor we will be more successful if we provide a reason. People simply like to have reasons for what they do.”

Robert B. Cialdini

It is a classic book that helps readers understand the principles of persuasion and how to apply them ethically in business and everyday life.

Cialdini, a renowned psychologist and researcher, draws from decades of research to identify six key principles that influence human behavior:

- Reciprocity

- Commitment

- Consistency

- Social proof

- Liking

- Authority

- Scarcity

Cialdini shows how these principles work and how to use them ethically and unethically to influence others.

The book offers valuable insights into human behavior and provides practical advice on defending oneself from manipulative tactics.

38. The Subtle Art of Not Giving a F*ck by Mark Manson

“Who you are is defined by what you’re willing to struggle for.”

Mark Manson

Mark Manson’s Subtle Art of Not Giving a F*c ” has become immensely popular along readers. It has been praised for its honest and refreshing perspective on life.

He challenges traditional self-help and positivity cultures and advocates for a new way of thinking about life. He says we must accept our limitations and understand that pain and suffering are inevitable.

Furthermore, he says to stop trying to be happy all the time and focus on what’s really important.

39. Who Moved My Cheese? Spencer Johnson

“Who Moved My Cheese?” is a bestselling self-help book that outlines five principles of personal change.

The key message in this book is that life is full of unpredictable changes; we can’t control them, but we can easily adapt and effectively handle the changes with a positive attitude and mindset.

Using a positive mindset and strong willpower, you can still grow in any painful situation in life.

The book is structured in three parts.

- The first part sets the scene and introduces the characters.

- The second part is the main story, where the characters deal with the change and its consequences.

- The third part discusses the lessons it teaches and how to use them in life.

Best Self-help Books On Mindfulness

40. The Miracle of Mindfulness’ by Thich Nhat Hanh

“If we are not in control of ourselves but instead let our impatience or anger interfere, then our work is no longer of any value.”

Thích Nhất Hạnh

The Miracle of Mindfulness is a profound and practical guide to cultivating mindfulness in everyday life.

The author offers a simple yet powerful approach to living fully in the present moment, drawing on his in-depth understanding of Buddhist teachings and his own personal experiences.

Nhat Hanh emphasizes the importance of being fully present in each moment. The book gives advice on how to practice mindfulness and meditation in everyday life.

How to reduce stress and increase inner peace and happiness.

41. Practicing Mindfulness by Matthew Sockolov

“Kindness is an essential part of practice—and that starts by being kind to yourself.”

Matthew Sockolov

Sockolov provides a clear and accessible introduction to the practice of mindfulness. The book contains insights and techniques for reducing stress and increasing inner peace and well-being.

The book tells you how to meditate and how to use mindfulness in your daily life.

He also explores scientific research on mindfulness and provides insights into its benefits for mental and physical health.

42. Wherever You Go, There You Are by Jon Kabat-Zinn

“Perhaps the most “spiritual” thing any of us can do is simply to look through our own eyes, see with eyes of wholeness, and act with integrity and kindness.”

Jon Kabat-Zinn

The book shows how to be mindful daily and gives tips for reducing stress and feeling better.

It includes detailed instructions on cultivating mindfulness in everyday activities such as eating, walking, and working. Common obstacles to mindfulness include distraction and self-criticism.

The book stresses the importance of not judging other thoughts and emotions.

The book is written in a friendly and accessible style and includes numerous exercises and practices to help readers develop their mindfulness skills.

43. Mindfulness by Danny Penman and Mark Williams

“See our thoughts as mental events that come and go in the mind like clouds across the sky”

Mark Williams

The book explores the concept of mindfulness, its benefits, and how to incorporate it into daily life.

The authors provide a comprehensive eight-week program designed to help readers dissolve anxiety, stress, exhaustion, and unhappiness.

The authors provide step-by-step instructions on practicing mindfulness, including mindful breathing, body scanning, and meditation techniques.

They also discuss the scientific research behind mindfulness and how it can help reduce stress, anxiety, and depression.

Best Self-Help To Improve Health

44. The Obesity Code By Dr. Jason Fung

The rising rates of obesity are a major health crisis around the world. If you’re struggling to lose weight, it might feel as if all hope is lost.

However, Dr. Jason Fung’s book, “The Obesity Code,” offers a groundbreaking perspective on weight loss.

Dr. Fung sheds new light on how hormones are linked to healthy eating and weight loss. He focuses on the hormone insulin and how it appears to be the key to controlling metabolism. We can become fat because of our insulin resistance.

His research points to a surprising culprit and offers a clear, actionable path to reversing obesity.

45. How Not to Die by Dr. Michael Greger

“The primary reason diseases tend to run in families may be that diets tend to run in families.”

Michael Greger

“How Not to Die” by Dr. Michael Greger provides evidence-based guidance on how to prevent and reverse chronic diseases through diet and lifestyle changes.

He discusses the benefits of plant-based diets and advises on incorporating healthy foods into daily meals. It also teaches about nutrition and how it affects health.

A plant-based diet and other healthy lifestyle habits are provided in evidence-based advice on preventing and reversing chronic diseases.

He emphasizes the importance of a whole-food, plant-based diet and offers tips for adding more fruits, vegetables, whole grains, and legumes to your diet.

47 Ikigai

Do you want to live a long and happy life? Do you want to find your purpose and see life differently? If so, then the Ikigai book summary is worth reading.

This ancient Japanese philosophy has enveloped how Japanese people live, and some believe it’s even the reason for their happiness and longevity.

Many people in Western culture have chosen this way of finding a meaningful career.

48. The Well Plated Cookbook by Erin Clarke

The book features over 130 recipes that are healthy, delicious, and quick and easy to prepare.

The recipes in the book are designed to be flavorful and satisfying, using fresh and wholesome ingredients.

The book includes recipes for breakfast, lunch, dinner, snacks, desserts, and drinks. Each recipe includes detailed instructions, ingredient lists, and nutritional information.

Clarke says that it is important to use real, whole foods and gives tips for planning healthy meals.

Best Self-Help Books On Relationships

48. The Seven Principles for Making Marriage Work by John M. Gottman, Ph.D.

“Working briefly on your marriage every day will do more for your health and longevity than working out at a health club”

John Gottman and Nan Silver

The book presents seven essential principles for creating a strong and fulfilling relationship and teaches you how to develop your emotional intelligence and communication skills.

Infidelity and trust issues are common problems in marriages, and the book offers ways to fix them.

It gives useful advice for building and keeping a happy and healthy marriage.

49. Big Friendship by Aminatou Sow and Ann Friedman

The book chronicles the authors’ friendship, which began when they met strangers in their twenties.

Through their personal experiences and research, Sow and Friedman examine the challenges that can arise in female friendships, such as jealousy, competition, and miscommunication.

They also discuss the unique cultural and societal pressures that women face when it comes to friendship and the importance of prioritizing and investing in these relationships.

Big Friendship encourages readers to consider friendship more important than romantic or family relationships.

50. Adult Children of Emotionally Immature Parents by Lindsay C. Gibson, Psy.D.

The author of this book provides numerous instances of how emotionally immature parenting can manifest in diverse ways, including neglect, abandonment, overprotection, and control.

The book also offers practical strategies for healing and moving forward, including developing healthy boundaries, improving communication skills, and practicing self-care

Comments are closed.